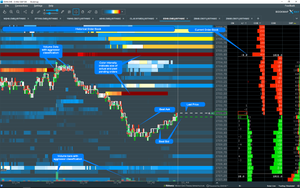

ES 06-18 / 14. May 2018

Traded ES volume was 919.617 according CME settlement data.

Long Term High Volume

Long term high volume is defined as high liquidity on the passive side of the order book which is sitting on price levels for longer period of time.

Price is always seeking levels of liquidity. It could be short term liquidity which is usually used to push buyers or sellers to a certain price level or it could be longer lasting liquidity in the book which is placed by institutional actors to achieve their intentions.

Today we had an excellent case where high liquidity was sitting with >1500 contracts on the offer for a while.

At this point the buying power was too low to penetrate this level. Buying volume was completely absorbed by the offer. Second try ended in an exhaustion of the upmove.

IF the aggressive buyer or seller is unable to "take out" the level where absorption is occurring then the market will often bounce away from the area of absorption as the aggressors are quick to cover their positions.

Let's have a look at another excellent trading area this afternoon.

The afternoon context was, if you look at a candle chart, a sideways move aka rectangle. This was clearly visible and defined in Bookmap™ by the Long Term High Liquidity sitting at 2732.00 and 2724.00. Facts, no room for speculation.

Absorption and Exhaustion took place around 12:30pm (EST). If you look closer at the screenshot above you'll see an order book imbalance at 2726.00 which pushes the price back up. It was supported by initiative buying.

Same situation happened at 2725.00 at around 1:15pm (EST).

Initiative buying or selling is always a good point considering to place a trade because we had following conditions at these levels:

- Context of the market was sideways (rectangle)

- Absorption and Exhaustion at LTHL

- Imbalance on the book - pushing price away

- Long Term High Liquidity below / above

- Initiative Buying above the absorption / exhaustion

Enough reasons to take some points off this market with a probablity > 50%. What do you think?

Comments