Advanced Trading Techniques

One of the most influential trading books I have ever read, was an interview by Art Simpson with the "Phantom of the Pits".

This is not a book in traditional sense, but a interview with a pit trader who wanted to be called Phantom. Phantom who has been trading for 30+ years and now wants to give back to other traders on his view on what is a better way to trade, especially for small traders. He gave out his 3 trading rules that he follows and those interviews reveal his market insights. Here are some questions answered by Phantom's insights.:

- What is the Important aspect of trading?

- You need to trading plan for entries, and why do you need to.

- His view on daytrading, and how to apply his rules.

- Many market condition, such as, how funds bid markets so they can sell the market and what should you do.

- Is market always correct? Not so by Phantom.

He went into great details on why he use them, the psychology behind these rules and the benefit of his rules. His rules can be a great enhancement to any trading system.

Rule 1

"In a losing game such as trading, we shall start against the majority and assume we are wrong until proven correct!"

Trading is a losing game, and the best loser is the big winner!

"Rule 1 is designed to protect you from ever being in a situation of distress. In distress you will make the wrong decision in trading most of the time."

"Positions established must be reduced (We do not assume we are correct until proven wrong) and removed until or unless the market proves the position correct!"

We allow the market to verify correct positions.

"It is important to understand that we are saying the one criteria for removing a position is because it has not been proven correct. We at no time use as criteria for removing a position the fact that the market proved the position incorrect. There is a big difference here as to how we treat all positions from what most traders use. If the market does not prove the position correct, it is still possible the market has not proven the position wrong."

If you wait until the market proves the position wrong, you are wasting time, money and effort in continuing to hope it is correct when it isn't.

"What makes this strategy more comfortable is that you must take action without exception if the market does not prove the position correct."

Your thinking should be: When your position is right, you have to do nothing instead of doing nothing when you are wrong!

"Most traders keep their position until it proves to be wrong for them. I say don't keep any position unless it proves to be correct."

"Keep in mind that traders are usually unaware that trading is a losers' game."

He who loses best will win in the end!

"Treat it as a business where you only want the best merchandise for the shortest possible time in order to have the maximum profit with the least possible chance of failure. That is what Rule Number 1 does for you."

"My position was not confirmed in those first 15 minutes! It wasn't violated according to the nuances of my plan, but it also was NOT confirmed. Get out!2

"With Rule 1 you are freeing yourself from having to feel bad. You put the trade on based on the trade plan. The market either confirms and you now have a good position, or it doesn't confirm and you are not okay with the position and you get out."

"Simple! Only a big deal if you don't get out when it isn't confirmed as a good position. No need to ever feel bad. Most of your trades that don't confirm within a logical time frame are usually going to look bad sooner or later. Why not take the sooner?"

"Rule 1 will not protect you from wrong entries! That is your job. You must solve your own conflicts in your trading. Rule 1 did take you out of the trade on the close because you were not proven correct based on the required criteria."

"When a market doesn't go up anymore, somewhere it isn't correct to stay in the position, regardless of the expectations. The market must prove and continue to prove. There can be simple or complex strategies in your program, but when the position is not going according to the expectations, it is wrong - not when it proves your stop price got hit."

Rule 2

Press your winners correctly without exception.

"Correctly" in Rule 2 means you must have a qualified plan of adding to your position once a trend has established itself. The proper criteria for adding positions depends on your time frame of expectations in your trade plan.

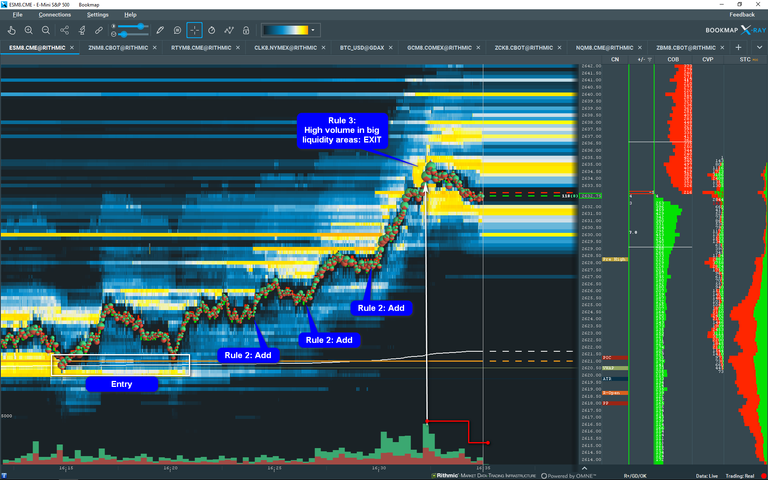

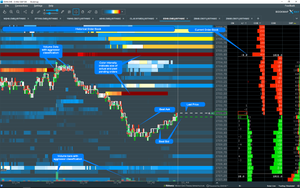

See this example:

"The important point of Rule 2 is to point out the rule is established so you can make the most gain with the least drawdown expectations."

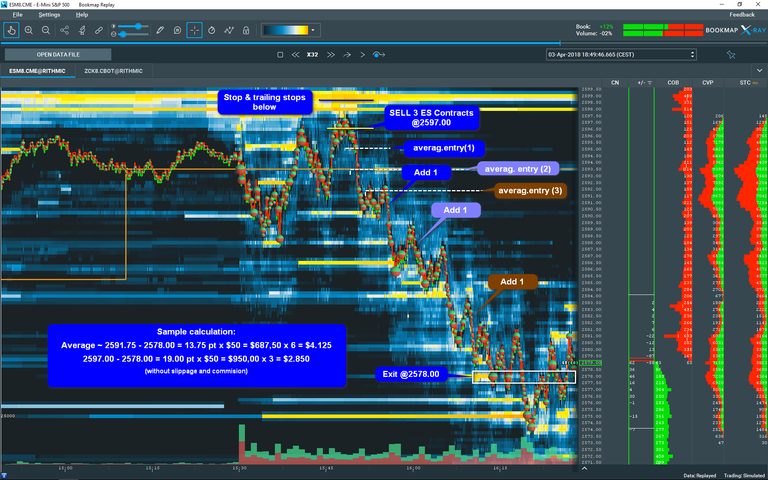

Example:

Average ~ 2591.75 - 2578.00 = 13.75pt. x $50 = $687,50 x 6 = $4.125

2597.00 - 2578.00 = 19.00 pt x $50 = $950,.00 x 3 = $2.850

"Always a good reason for adding to a winner is because traders usually tend to doubt the position unless they reinforce the correctness of that position. Adding to the position correctly best does this."

"Your plan for adding positions could be as simple as using each buy signal for longs and each sell signals for shorts. It could be on retracements or support lines."

The intent of Rule 2 is twofold: Reinforce your correct position both mentally in your thinking and your execution and increasing the size of your position.

"Daytraders will have a problem with Rule 2 unless they position properly and understand that their adds must only be made correctly. Daytraders are in for the quick profit so it is hard to have a good add plan. Their best trade is to put all positions on at once - original and adds - and use Rule 1 to take them off unless or until proven correct. Believe me, this is the proper probability in a loser's game like trading."

"Rule 2 says you must add to your winners without exception. As a daytrader, you are only keeping a position if proven correct or until proven correct. In a sense the market is deciding how large your position will be. The variable can be from all to none in this

situation."

"Well, don't take your profit. Add to your position. Then, if it doesn't prove correct, take your remaining profit and expect to re-enter at a different level. So what if you lose a few ticks because you put an added position on and it was wrong! You will get enough lead on adds that you won't ever think twice after you see the runaway markets! It isn't because I say so but because the market catches traders the wrong way. It is seldom that it's not the case."

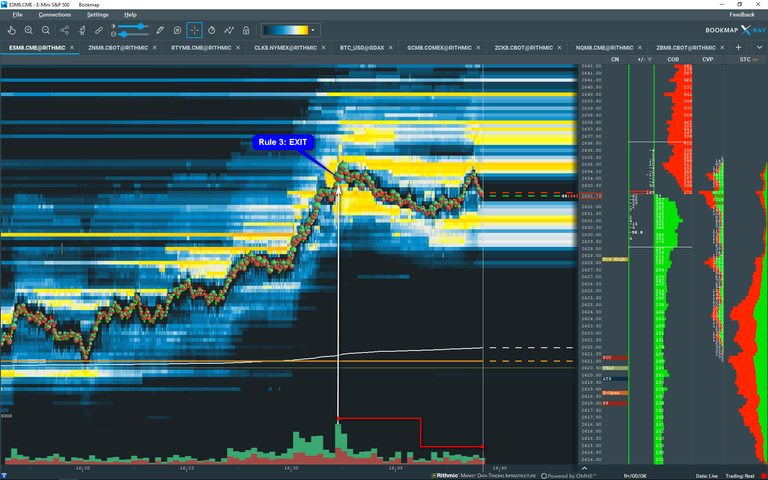

Rule 3

Rule 3 is intended for traders who are holding a position for several days.

"We shall go against the majority and assume the market is not always correct (those times being when liquidity is poor). At those times we shall question all signals and wait for future signals for positioning."

"We shall use the converse of poor liquidity and remove our existing positions when extreme liquidity takes place in two steps and within three days of extreme high volume. Half of our postion shall be removed immediately the following day after an extreme high-volume day. The other half of our existing position shall be removed within two additional days. We shall wait for further signals in those cases for future positioning."

For daytraders it could be varied to the extend that a position shoud be removed when extreme liquidity takes place. On this Blog I have pointed out nearly every day that in case of big liquidity or rapid moves up it must be considered to remove the positions or at least tighten the stop.

Example:

"Find the positive in taking small losses rather than getting wiped out. Find the positive in the simple rules we have given you to use. Decide what you want to do with the guidance you have been given!" Phantom of the Pits

True words. Leave a comment and add your ideas how to profit as a daytrader from his advise.

Comments