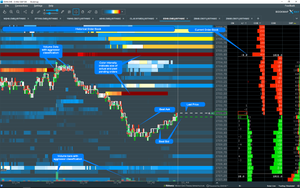

ES 09-18 / 10. August 2018

Trading ES Future on Friday, 10th August 2018 was'n easy. Although there were enough political news and tweets about tariff issues between USA and Turkey which send the ES down before regular opening, uncertainity existed throughout the regular open too.

Main question on such days is: What strategy is best to profit of the current situation?

Let's see the usual candlestick chart of Friday.

During the first hours it was difficult to see an opportunity although a trader could take tops ans bottoms to place his trade. On Twitter I wrote:

you can lean on the short or long side - you are always right #ES_F pic.twitter.com/7E16Q9DudI

— ttwatrader (@ttwatrader) 10. August 2018

As every single day reading the order book and trying to follow the liquidity helps me to make some good trades on this day. Some of them I want to document for learning purposes.

Spoofing

My first trade was based on spoofing.

It was so short and hard to see. There is no chance to see such behavior on a normal chart. When spoofing occurs it tells us that an interested party wants the price at a certain price level. When market reaches the price level they are buying or selling massively at that level. For me it was a reason to buy after the liquidity was absorbed at 2837.00.

Area of High Liquidity

Second trade was justified by a high liquidity area between 2842 - 2844. It was preceded by high volume traded at 2842. When high volume is traded at a certain area it means that there are no buyers / sellers for a moment. Price reverses and if the trend is strong fresh buyers / sellers comes in with the power to lift the offer. If the trend is exhausted then price hoovers around the area because there are lot of traders who are trapped and try to buy the offer. But if there aren't enough buyer or in other words, if the liquidity on the bid or offer side is too big, like in the example above, then they failed to buy all the liquidity at this particular level.

Reversals

In my opinion the most secure trade.

Because it is always accompanied by absorption. Big volume is traded at 2030.00. Sellers have been absorbed and no new sellers are immediately(!) there to push the price lower. If there are no more sellers the matching machine auctions back until the next "vacuum", or in other words, until the next level of absorption.

You will find reversals in firm trends and, from my point of view, they are the most reliable setups I have found in my trading career.

The hardest part of trading is patiently waiting!

Leave your impressions and thoughts in the comment section below.

Comments