ES 09-18 / 19 June 2018

One of the worst enemies besides discipline, patience, boringness etc. in trading is to have a BIAS about the market before the market opens and during trading hours.

Cognitive Bias is defined as: "Common tendency to acquire and process information by filtering it through one's own likes, dislikes, and experiences". Source businessdirectory.

The problem with common charts and their vast variations is that these charts are always displaying lagging information. To omit this basic problem with common charts we need some guidance in order to make up an opinion about the market, his state and the predictions we need to take an action upon it. Thousands of indicators for hundreds of charting programs were developed to "support" us in our trading decision. But nearly all of them are crooked sticks.

The point I want to emphasize here is that many, many traders are defending their own systems and the ideology behind it without realizing that they are processing their information "by filtering it through one's own likes, dislikes, and experiences". In other words, having a Bias about the market and what the market has to do. In most cases a biased opinion lead to wrong trading decisions.

To be open: It is hard to stay unbiased every trading day. I don't want to critisize this human behavior because we all suffer from that psychological attitude.

I would like to motivate every trader to think closer about objectivity in trading. Is it even possible to be and stay objective in trading? If yes, how can it be reached?

My opinion is that first and foremost besides the psyhological aspect of our behaviour the neutral and objective view of the market is paramount.

Todays trading day showed several examples. Here is one of them:

Correlation between markets matters. If you trade ES Future, watch NQ and YM Future. You can also choose FDAX Future in the pre session. All those indices are non laggig indicators.

Trading treasuries means watching ZN, ZB, ZF and in the pre session for example the BUND to get a clou what the market is doing.

The art of trading in case of objectivity is to let personal opinion out and let the market tell us in real time what is happening. Then we can act upon the given facts. That's what I understand with objectivity in trading.

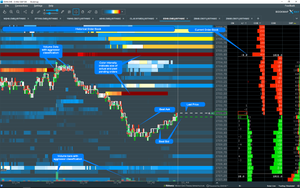

There is a bunch of examples every day. Let's recapitulate the sell in ES @ 2763.00.

In the example above it was clearly visible that long term high liquidity was at the price levels in the book for YM, NQ and ES and that at these price levels the volume or traded contracts were unloaded which was evident by large volume clusters.

Market is telling us: "Here is the limit." No guessing, no bias needed. Either you was long and this was the place to take your profits and/or to take a sell position here. With clear defined R/R ratio.

In order to act like described above you need first an order book or a visualisation of an order book like Bookmap™. Secondly you need "Market-by-Order" data with unlimited DOM levels. And third you need a good understanding about the mechanics and function of an order book.

Now comes the hardest part into play: Patience! Let the market tell you what he actually do and what is he planning to do.

Would be happy to learn your opinion about objectivity in trading. Leave a comment!

If you want to learn more about our inner "traps" I highly recommend to read Daniel Kahneman: "Thinking, Fast and Slow".

Comments