Risk and R-Multiples

Based on my trading experiences and discussions with other traders I am repeadedly astonished how carelessly risk management is handled or viewed. Although you can literally find thousands of articles about risk management and advisors on the Internet.

This article is a supplement to MAE and MFE with Bookmap and completes the discussion on performance and risk management.

There are 2 rules to obey:

Never open a position in the market without knowing excatly where you will exit that position!

Cut your losses short and let your profits run!

Let's look at the first golden rule in much more detail. It says that you must always have an exit point when you enter a position. The purpose of exit point is to help you preserve your trading capital. It defines your initial risk (1R) in a trade.

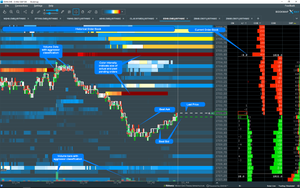

In my blog I am writing about order flow and liquidity and all samples will be shown as they appeared in Bookmap™ X-Ray

You are selling at 65 and if price goes against you, your initial risk are 2 points. In this case 1R is equal to 2 points or $100 (ES 1 point equals $50 - without commission).

1R represents your intial risk per unit. It is simply the initial risk per share of stock or futures contract or minimum investment unit. Keep in mind that it isn't your total risk in the position, because you might have multiple units.

Total Risk

Your total risk would be based on your position sizing and how many shares or futures contracts you actually buy.

Let’s say you sold 10 ES futures contracts in example above. You are only willing to risk 2 points, so 10 futures contracts multiplied by $50 per point x 2 = $1000 total risk for this position.

R-Multiples

The next key point for you to understand is that all of your profits and losses should be related to your initial risk. You want your losses to be 1R or less—which means that if you say you’ll get out of a future when it goes against you from 65 to 67, you actually GET OUT when it hit 67. If you get out when it hit 69, your loss is much bigger than 1R. It’s twice what you were planning to lose, or 2R. You want to avoid that possibility at all costs.

Instead, you want your profits to be much bigger than 1R.

See example above, you sold 10 ES future contracts at 65 and plan to get out if it drops to 57, so that your initial 1R loss is 2 points per futures contract. If you go on to make a profit of 8 points per future contract, you’ve made 4 times what you were planning to risk—in other words, you’ve made a 4R profit.

R-Multiple = (Expected Exit Price - Entry Price) / (Entry Price - Stop Loss)

Example

R-Multiple = (2723,50 - 2719,50) / (2719,50-2717,50) = 2R

Percent Profitable

This simple formula helps to calculate percent profitable.

Win Rate Calculation

©2018, Sergey Bondarchuk, bookmap.com

Win-Rate = Stop-Loss / (Stop-Loss + Profit)

Example:

Stop: 5 Ticks; Profit: 15 Ticks; Win Rate = 5 / (5+15) = 0,25 = 25%

Risk Playing Mode

There are different working trading strategies and they all depend on the expected value. In principle, there are 2 values to be considered:

- Percent Profitable = share of winning trades in all trades

- Ratio Average Win / Average Loss = R-Multiple

Often there are players who place their stop to 4 points and try to gain 1 or 2 points. In other words, the profits are always small and the losses large. Let's assume for simplicity that the selected stop is 4 points and the selected profit is 2 points.

This is then equivalent to a R-Multiple of 0.5. However, slippage and transaction costs still have to be taken into account.

If the stop is set at 4 points, a market order is used to sell, so that the actual loss is slightly higher. When you win, a limit order is set, there can't be slippage.

Let's simply assume that the actual loss, taking slippage and transaction costs is 4.2 points. The actual profit taking transaction costs is only 1.9 points. Our R-Multiple shrinks to 0.45.

| Loss (+ Slipp., Trans.) | Profit (+ Slipp., Trans.) | R-Multiple |

| 4,2 | 1,9 | 0,45 |

For example, if you want this strategy is going to work for you, you need a very high win rate.

| Win Rate | Loss (+Slipp,Trans.) | Profit (+Slipp,Trans.) | R-Multiple |

| 70% | 4,2 x 0,3 | 1,9 x 0,7 | 0,07 |

| 80% | 4,2 x 0,2 | 1,9 x 0,8 | 0,68 |

| 90% | 4,2 x 0,1 | 1,9 x 0,9 | 1,29 |

You need a win rate of at least 85% -90% to win on this strategy. If you make only one point profit with a stop of 4 points, then the problem is of course dramatically aggravated.

This example shows that, however, it is possible to make profits with a high percentage of Percent Profitable and a poor R-Multiple!

The main problem with these strategies is position sizing. Since the losses are relatively large, a few unfortunate losses can lead to a sensitive drawdown.

For this reason, such a strategy is less scalable with the same risk of ruin than a strategy that often generates small losses and occasionally large profits.

Comments