"The Lure" - Revealed with Bookmap™

There are several "poetical" terms which try to describe the pitfalls that exist in trading like "The Smackdown", "Push and Pull", "Head Fake Level Smash" and many, many others. Every trader can create his own personal term based on his trading style and trading experience. There are no rules.

The lure describes a technique which we can see very often in an order book like Jigsaw or Bookmap. It requires experience and knowledge to recognize this setup and put it in the right context.

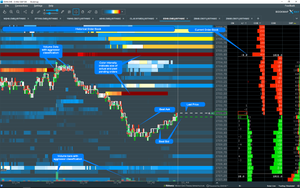

The lure is a reversal setup which needs time to develop. ES 09-18 future from 13th August 2018 gave an excellent example about the intentions of the market agents.

In General, the lure describes how market agents are luring or locking in buyers to sell all their inventories to them and then pulling the bids in order to let the market go down.

As soon as the market goes bid they are bidding an unusually big amount of contracts at 2841.25 and 2841.00. Every informed trader see this levels and think that the market is strong. Now the buyers are lifting the offer by buying everything they can get. In reality market agents are selling their contracts to the buyers. By adding to the bid and offering at the offer a small amount of contracts the market agents are making this market look strong for long positions at that spot.

We can see this behavior in the order book on the offer side when stacking of orders refreshes all the time when price rises.

Did you see what is happening here? Market agents are pulling their offers and adding to the bids a significant amount to lure in buyers. Once they have sold enough they are cancelling their bids and hitting the remaining bids with their volume to eliminate the support at 2841.00. At the same time they are making the market weaker by pulling the bids.

Watch this short video for better understanding.

Why are traders placing fake orders?

First of all I wouldn't speak of such thing as a "fake" bid or offer. It is a "No Intention" to buy bid or to sell offer orders though. Basically, the reason large traders (and some smaller traders in thin securities) do this is to give the impression that there is either an abnormally large buyer or an abnormally large seller in the market.

Consider the following:

If you have a large amount of stocks e.g. 100.000 or future contracts e.g. 1000 to sell, then you can't do it all at once because you would manipulate the price to your disadvantage.

Likewise if you display the order to sell on level 2, people may see that there is a (legitimate) large seller in the market and sell, driving the price down and preventing you from selling where you want as well as lowering the value of your investment.

Another option could be to sell 1000 future contracts but hide it on level 2 as not to scare people. Otherwise you could place 200 contracts to signalize to smaller traders that there is enough liquidity that they can buy 50, 100 or more contracts if they want, but not so much that there is a need to have 1000 and more buyers behind them to make the price go up.

The problem with all of this is that you want to sell lot of contracts / shares into a market that doesn't have a lot of buyers.

You need demand. To create demand you might display/spoof/fake a buy order with NO INTENTION to buy of, let's say 500 contracts on the bid. Now it seems that there is a large buyer in this market. This will create demand and entice retail/uninformed traders to buy. They wil buying from you as your hidden order fills piece by piece.

This is a risky game for the seller, though. As mentioned above there are no such things like "fake orders". This 500 buy order is real at that moment! If there is a big seller right at that moment when the intentional seller is trying to find buyers for his inventory and if he doesn't cancel his orders fast enough he will get a fill and will be long 500 contracts more.

That's the real risk of placing "non intentional" orders. Beside it is illegal under the 2010 Dodd-Franck Act.

Everything can be inverted to spoof on the sell side and create artificial sell pressure if there is a need to buy before the price goes up. Both of these things are, despite being illegal, practiced pretty regularly by manipulative hedge funds and large traders.

HFTs do this too but very, very fast so you often won't catch it on level 2 unless you are working with a level 2 visualization software like Bookmap™ is. Algos can use it as a method of price discovery also.

Please read also "Why - Trading Questions answered" article.

Feel free to add your comment below.

Comments