Trading Depth Interview #1: Walter Lesicar, the Trade-To-Win Trader

Please see full interview here:

https://bookmap.com/blog/depth-trading-1-interview-walter-lesicar-trade-win-trader/

Bookmap launches “The Depth of Trading” – a series of inspiring interviews with successful traders. Their background and strategies vary, but you will find them useful for sure.

Walter Lesicar opens this rubric. He is trading futures for more than fifteen years and has quite an interesting life philosophy. Enjoy reading.

Hi Walter. Thank you for your time and thoughts. Why did you agree to this interview in the first place?

Thank you, my pleasure. I think it was curiosity.

How about your blog? Why do you share successful strategies?

I started my blog because I wanted to structure my collected trading knowledge. It wasn’t clear at the beginning how should I do that, but when I saw this great blog software which is easy to use and produce static websites I was on the hook.

It was my intention to share my ideas around trading to document my trading actions and eventually give other people some additional inspiration in this business.

What was your very first motivation to start trading? Have you ever thought as a kid you would become a trader?

I have never thought to be a trader, certainly not as a kid. It was an event that hit me very hard personally. I had left a significant investment in a bank for administration. Around 2001 there was almost nothing left of this investment. When I talked to those fund managers about the development of this investment, they were ignorant and just made it worse. This was the birthday of my quest into trading.

So nobody’s born a trader. Rather, trading could be compared with a marathon. But is there a personality type which is more likely to succeed. What do you think?

As you said, nobody is born a trader, as well as nobody, is born a violin master. You become the master when you urge to achieve something, but to achieve your goal you must practice, practice, practice. There is no easy shortcut. Malcolm Gladwell’s book “Outliers: The Story of Success” describes that the essential ingredient to become successful is not talent but practice.

Is there a personality type? I believe that you must be stubborn regarding your goals. I love this saying from Winston Churchill: “Success consists of going from failure to failure without loss of enthusiasm.”

Trading is going from failure to failure because there is no university where you can study “Trading” in a regulated and comprehensible manner. There are so many “robber barons” in this business, and each of them is promising you wealth, meaning their own wealth.

Coming back to the personality: one must have the absolute willpower to become a master in what he is doing, a strong will to achieve this goal, complete faith in oneself, long breath to overcome all hurdles, and mental flexibility to evolve with time and technology. In my opinion, it is the worst case scenario for a trader following an ideology. Stay independent!

What are the characteristics that make a trader a “great trader”?

As I said, willpower is the driving engine for everything we do. Characteristics should be: willpower, desire, commitment, flexibility, ability to lose, serenity, distance, ego control, bias flexibility and ability to not care too much about yourself.

Imagine that you could go back in time and give yourself advice before starting to trade. What would it be?

Don’t trade! There are easier and funnier ways to make money for living.

Do you trade full-time?

Yes, I am a discretionary trader, and I am trading full-time. With one restriction: when I reach my goals according to my trading plan for the day, I quit and enjoy my day. I am trading for profit, not for the sake of trading.

Tell us about your trading plan.

My experience showed that trading is a game of losing, so to enhance my chances I must have a strategy and a plan that fit my life and my personality. It describes what, when, how and how much of my risk capital to trade and, more importantly, when to quit. My strategy is based on Order Flow and Order Book reading, and that increases my probability to win greater 50%.

What is your attitude towards risk management? How much do you risk per one trade?

I am risk-averse. I don’t like losses. But losses are an inevitable part of my job. So this leads to some protections I have learned from other traders and developed for myself.

A trade starts with minimum contracts to see whether the market goes in my direction or not. If the market goes in my course, I am looking to add additional deals to my position. This allows me to get the most out of a move.

My motto is: “If a trend becomes obvious, you are too late.” My stops in ES are 1,5 – 2 pts. When a trend starts, I am tightening and trailing my stops. Either the move runs in my favor or not. I do not and never wait until my stop is hit only because I have set a stop if the price goes against me.

I am aware that there are a lot of stop recommendations from “Don’t use stops!” until “Tight stops destroy your profit!” Anyway, I have developed own way to manage my risk.

Do you believe that trading long positions is easier than trading short ones as some traders claim? For how long do you hold a trade?

Short positions are more exciting to me because when I am “on the train”, I profit faster from the short trade. As long as a position goes in my direction, I am okay with both directions.

Since I am a day trader, I close all positions when I reach my daily goals.

Have you ever panicked? How did you feel? What lessons did you learn when reflected upon the situation after that?

Oh yes, I did! It was at the beginning of trading when I didn’t have a clue about position sizing, stop management, etc. It was more gambling than trading. When I realized that a trade went against me, I added more to the losing position, and it went worse and worse.

Fear and sweat controlled me! The incapability to act paralyzed me. I lost a lot and thought that this money would be better invested in my kids instead of this sick idea. And you know what, that experience is in my bones until today.

This was the time when I promised myself to stop gambling and start to understand what the market is, how to analyze it and what trading principles must be learned to become a trader. It took years to come back.

Can you name your biggest mistake? What are the most common mistakes traders do?

My biggest mistake was to follow people blindly for some time, but they were as blind as me. It looked like trading an ideology — a faith rather than the market. If one has little knowledge and is undereducated in trading, he is more willing to follow other people and hope they will be honestly interested in him.

Most common traders’ mistake is relying on other traders, automatic strategies and trading systems. It is simply because they want to get rich in a short time, or they are financially under pressure.

A good example today is the cryptocurrency market. Look around and see people blindly following market crier who proclaims that only their cryptocurrency is the true one with 40% return on investment per month!

Develop your own system! Learn and practice in a simulation account! Although there are enough good and honest traders, who will support you, learn to walk by yourself.

In case of trading, the following saying is so true: “Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime.”

Would you recommend trading to your family members and friends?

If you have had asked me this question 10 years ago, I would have answered: “No.” At that time, I had no direction to follow, though my knowledge about charting, technical analysis, and indicators was sufficient. I was like a leaf in the wind: I followed certain people and especially their trading ideology that didn’t quite work for me. I expected to “trade-for-living.”

It changed when I came in contact with professional traders on a trading floor in the UK nearly ten years ago. Then I realized that they are working with an “Order Book.” At the same time Peter Davies launched his Jigsaw Trader which was affordable to me, and so I dived into the world of order flow and order book reading. It was a hard time learning to read an order book, but over time it became more evident. Some years later the first version of Bookmap was launched. From then on, the idea of real trading became more and more solid and clear.

Today I would definitely say “YES.” With today’s technology, I can recommend and teach them how order flow works and how to trade.

What traders do you admire?

Myself (laughing). Because I stayed stubborn and wanted to learn how to trade.

What indicators did you find the most useful?

Interesting question. I know them all — or nearly all. When I began trading, I started with a harmonic pattern, 1:1nes, Gartleys, Butterflies, Fibonacci’s, Elliott Waves, Gann, every kind of indicators you can imagine on different trading platforms. I believed that a candle or whatever chart is the truth. Nothing is further away than that!

For example, a candle chart is an object of no significance for me today. Thinking positive, a chart with indicators gives me at best a 50:50 probability chance to win. To be successful in trading you need at least a 51:49 probability chance to win.

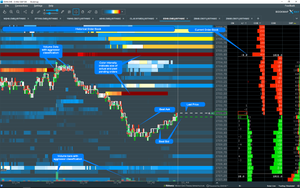

Understanding order flow and order book raised my chance, I guess, to at least 60% or more. That’s just because I see real time what is happening on the Bid and Offer side, where is absorption, where is a continuation when the market orders come in. Simply going with the flow when it’s time. Real-time.

Whatever chart and indicator you use, none of them can show you what’s happening “inside.” Charts are using aggregated data and plot them as they just happened. By that I mean, I know what happened, but I don’t know what is momentarily happening. No indicator gives me a view inside. For example, an RSI can be overbought or oversold for a long time. How can I profit from that? Of course, when I add more indicators I know.

However, I am used to candle charts since the beginning, and I use them today as my overview on weekly, daily and minute base. My indicators are only so-called non-lagging indicators like VWAP, Pivots, Open Range, ATR as my stop trailing system.

What tools do you use for trading?

I am using Bookmap as my guidance through the day. This visualization technology based on the order flow has eased my life to a great extent. Mostly I trade only high liquid instruments like ES and ZB. I see and understand who is in the game, who controls the game, who is canceling and deleting orders and how market orders are behaving. It is also possible to have a micro and macro look of the market within the subscribed instrument.

Visualization in trading became a relief for me, because watching the order book all day was too demanding for me.

As I mentioned, I am using a candle chart as an overview chart too, and I am using the plotted levels like Open, Y-Low, Y-High, Pre-Low, Pre-High, Y- Close, PP, ATR, POC, VWAP as information which are plotted at a glance on the chart.

How does your workday as a trader look like?

First, I try to avoid sitting all day in front of my screens. When I reach my target, I am out. I start my day with setting up my trading PC, charts, answering emails. Then I am out for gym exercising, cycling, jogging, etc. There is enough other administration work left. Having a balanced day is essential for traders because it is easy to become overtraded and then failures are programmed for sure.

Please see full interview here:

https://bookmap.com/blog/depth-trading-1-interview-walter-lesicar-trade-win-trader/

Comments