What to trade?

My Blog is about Order Flow and Liquidity and that has a direct impact on instruments I trade. Reason is simple: I want to keep control over all aspects of the traded instrument (not market!). This is the reason why I am trading Futures.

When you start to play with the thought to become a trader for good reasons next question is: What should I trade? What is best for me?

There are numerous possibilities to trade something. You're spoilt for choice!

And "best for you" includes a numerous implications like: best for you money, best for your psychology, best for your personality, best for your life time etc.

What fit best your trading style depends on your preferences and learning style.

In this article I will summarize my experiences and give my advise. I am fully aware that there are many other possibilities.

Liquidity

Trade only liquid markets!

What do I mean with liquid markets? Aren't all markets liquid? Especially Forex markets?

Let me explain what I mean with "liquid" markets from an inside view in the Limit Order Book (LOB).

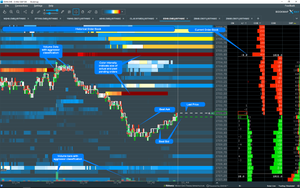

As you can see for each of this markets you have on the Bid and Offer side relatively low limit orders sitting. Euro/USD about 30 until 100 in peak times. Oil has also quite low limit orders sitting on both sides ot the order book.

In comparison to this high liquid markets like ES, ZB, ZN, Corn etc. this instruments makes above shown markets look really "weak".

This has an significant impact on your trading style and the Risk/Reward ratio you always should be watching.

"Thinner" markets

- Has a more problematic R/R ratio because you need a certain "distance" (stop) to your entry price

- Are more volatile and therefore has a not optimal MAE / MFE expectance

- Has more violent and uncontrollable price spikes

- Are hard or absolutley not to watch with a LOB; you'll see nothing but numbers flipping up and down

- Can't be managed by spotting Support and Resistance areas; Liquidity is hard, if ever, to see

- Has higher slippage costs

- Are more difficult to manage; more stress, more adrenaline;

"Thicker" markets

- Are slow and sometimes boring; watching paint drying.

- Violent and fast moves are rare

- Give good visible information about liquidity

- Allow to see what market agents are doing

- Give time to prepare for entries or exits

- Has a controllable MAE / MFE expectation

- R/R ratio is better controllable

- Hardly any slippage; Limit orders are normally executed on the entry

Stocks

There is one reason why I am not trading stocks: Leverage. The leverage available in futures trading is best you cannot find anywhere else. Intraday margin is, depending what future product you trade, for example (Interactivebrokers March 2018) $1500 for ZB or (IB March 2018) $4200 for ES future.

I am controlling one ES future contract worth $210.000 with a intraday margin of $4200. That is 50:1 leverage. That means that I can move more volume for less money. This equates to a much greater return on investment. Due to high ES volatility in 2018 the intraday margin was raised. Under normal circumstances you'll get a much better leverage due to lower intraday margin. Even still it's better than anything you will get with stocks.

You can make money with stocks too, but with a lower leverage. I asked myself: Why should I risk my money on something which yield e.g. 20% when I can risk it on something which will yield 100%?

Don't forget taxes. Stocks are taxed differently then future contracts. This depends on the country you are living.

Same principles of trading applies of course for stocks and futures. Boys with big pockets and most money moves the market. You can reveal their tactics within order book like Jigsaw Trader or visualization tools like Bookmap™.

I was told that trading NASDAQ stocks is better then trading stocks on the NYSE because NYSE is run by specialist with deeper informations then a retail trader can get.

Treasuries

Are my favourite, if you would ask me what markets to trade.

Treasuries are the cheapest to trade. Comission is nearly as half as is for ES. See Comission Costs.

There are several treasury contracts: 30-year (ZB), 10-year (ZN) and 5-year (ZF). You have also the 30-ultra bond (UB). A lot of spreading takes place in this market. Quite often you can figure out where the market is heading. See also market correlation.

Treasuries are the most liquid markets after the Eurodollar. It is not a problem to get in and out when you want. They are rarely 10 tick spikes. This helps you to suit your tolerance.

Bund, Bobl, Schatz, Eurostoxx

For years, the Bund was the most heavily traded contract in the world. Bund, Bobl and Schatz are spread against one another quite often like the U.S. Treasuries but they are more volatile than the U.S. Treasuries.

Bund moves good but it is extremely easy to get shaken while trading it. Bobl or Eurostoxx are more stressless and Eurostoxx could be boring but it tends to trend really when it moves.

Emini S&P

Is my favourite besides the Treasuries.

Emini S&P has a plenty of liquidity and good volatility. Comissions are a bit higher as compared with U.S. Treasuries but is easy affordable. Best on S&P is the availibility of liquidity. You have the time and indications to see where liquidity sits and where not.

Euro Currency Future and other currencies on CME

Euro is by far the most liquid and is therefore the one you should focus on. It can move fast. There is enough volatility. Comissions are a bit high though.

Corn

Corn is the most liquid amongst grains and if you are going to trade grains, it should be Corn. But even though it is the most liquid of the grains you can not swing huge size. Sometimes it takes 300 to move the market 1 tick. Sometimes a 50 lot will move it 4 ticks.

One thing you need to keep in mind at all times is that this market is subject to limit movements and you need to know where this number is. If you get caught in a limit move against you, you are in trouble.

Energies

I am not a friend of trading energies. The high comissions don't matter much with the swings that are happening. There are times where they are not controllable and you feel as if monkeys are moving the market uncontrollably.

Options

I did it and dislike it. Options are artificially mathematical constructs with high comission cost which only pays off when you hit it bigtime. You give up so much premium that it's just not worth it. If e.g. time option erodes then you have nothing out of your option, even when the market is in your favour.

Forex

From my experience a clear NO-GO. Stay away from Forex markets.

Forex has exploded during the last years. Extremely high leverage and: NO COMISSIONS! TIGHT SPREADS! How tight? As low as 1 pip. They are gone to fractional pips since years. There is an enormous number of Forex dealers and there is tough competition.

Ask yourself: If someone isn't charging you any comissions, how do they make money?

It's called capturing the bid/ask spread! Forex dealers have an open line with big banks. Big bank gives the dealer a quote and then the dealer gives you a quote. The two quotes are not the same. There are no market depth screens for Forex because there is no market depth for you to see.

If you want in you have to hit their bid or offer and you are instantly down money. If the spread is 2 pips on the EUR/USD and you buy it, you are instantly down $20 per contract. If you instantly turn around and sell it, you have to sell it 2 pips lower for a loss of $20. This is $40 per contract per trade. Maybe it's not 2 pips it's only 1 pip. In less liquid pairs, it might be 4 pips.

Whatever, you will have hard times trading Forex in my opinion.

Comments