Why Confidence Matters

"Traders are rewarded for a combination of the intellectual and psychological ability, not for the mechanical ability." James Dalton

Day trading is one of the most complex and gripping businesses you can imagine. Day Trading involves many different aspects of our human mentality and nature as a whole. What is most important is for traders to interact properly with their own feelings, emotions, will-power and ability to work with one's own subconscious mind.

How can we achieve a state where all these complex abilities work in harmony together? Is there a way to overcome the fear our subconscious mind is sending all the time when we are about to enter a trade?

Yes, in my opinion there is a way to master the complexity of trading:

It is confidence in one's own action.

Without confidence in ourselves we can hardly achieve anything. This is universal and not a big secret

But how can we as traders work on our confidence? I will share what I did to come to a state of confidence which helps me to follow my profession as trader.

When I began to show an interest in trading, 15 years ago, there were a lot of different methods and approaches, like today. There was no clear line or education but just promises to get rich quickly. I started with Fibonacci's, Gann, Elliott Waves, Measured Moves, Gartleys, Planetary Harmonics then moved on to Technical Analysis and all sorts of common indicators.

For me, none of these methods and promises made me successful. I am not saying that these methods don't work. But they certainly didn't for me.

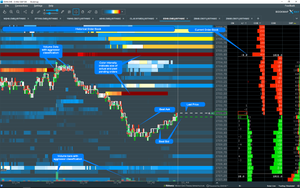

Later in my Day Trading career I studied James Dalton's "Markets Profile" and got in touch with "Order Book" which I haven't understood at all. From this time on, I felt that there was more then moving averages, divergences, Bollinger Bands, channels, zero lag oscillators etc. All of these indicators were showing me what happened in the past. So I had to rely on what happened in order to decide what was going to happen. This did not mesh with my personality.

During this time Peter Davies from Jigsaw Trading started with a project called "Jigsaw Trader". It was the first time a DOM was affordable and newly designed.

This topic fascinated me because now I could listen to the market and what it is saying in real-time, I was studying its behavior both in real-time and historical. Hunting the possibilities, and finding a subtle edge.

I began to understand the following:

- What is an Auction

- How an auction works

- How market orders influence limit orders

- How limit orders were pulled or stacked

- How market influencer's play with market participants

- The importance of volume

- Where support / resistance areas become visible

The order book approach allows me to read the Market, to listen its breathing, to feeling its intentions, to handling continual contradictions, to act in such uncertain and ambiguous Market environment, and at the same time keeping clarity of mind.

The order book approach allowed me to read the Market, to listen to its breathing, feeling its intentions and handling its continual contradictions, to act in such uncertainty and ambiguous Market environment, and at the same time keeping clarity of mind.

This means confidence to me!

I'd be happy to read your comments on this subject.

[Thanks @DetroitBrad for proofreading.]

Comments