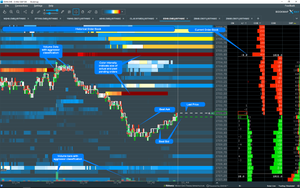

ES 06-18 / 08 June 2018

It is worth to document this trading day because we had excellent trading opportunies in the ES future which I want to post for further reference.

Volume was a bit higher then in the past day. ES June future traded today with 1,285,802 volume according BarChart.

1. The Start

We got a wonderful long term volume liquidity @ 2770.00 from the start of the ES session. It served as an anchor for trading actions and it was clearly visible. There was enough time left to prepare a trade around 2769 - 2770.

2. The Exhaustion

Above described long term volume liquidity was absorbed around 10:00 (ET) with a volume of approx. 870 contracts. As you can see in Bookmap™ macro view the price action at 2770.00 was exhausted. No more responsive buyers hit the offer.

3. The Turn

On the half way down from 2770.00 excatly @ 2766.00 every contract was absorbed by the buyers which was indicated by the book in an impressive way. Time to buy back the shorts and position oneself to the long side of the market. It was a clear buy above 2766.00. Nothing to discuss here.

4. Business done

After the downtrend was stopped book showed mostly imbalance on the bid side which means that the limit orders on the bid limit side were bigger then the limit orders on the offer limit side. As long as the price floated around 2766 and slightly above the bid side supported it at 2765.75.

5. The Run

Nothing to comment here.

6. Conclusion

To trade with confidence a trader needs objectivity in trading. From my experience it is worth learning to read and interpret the order book. Now it is easier then ever to be supported by order book software like JigSaw daytradr or Bookmap™.

The other aspect is the psychological side of trading and it counts more then any trading software in the world. But knowledge, confidence and objective tools can support to a certain extend the psychological aspect of trading.

Happy to read your comments about todays experiences!

Comments