Spot Pull Backs with Exhaustion in Bookmap™

According Investopedia exhaustion is described as:

"Exhaustion is a situation in which a majority of participants trading in the same asset are either long or short, leaving few investors to take the other side of the transaction when participants wish to close their positions. Exhaustion signals the reversal of the current trend because it illustrates excess levels of supply or demand."

Exhaustion and the Market Order Matching Engine

To understand how a price moves we should have a basic understanding of the "Market Order Matching Engine". The purpose of the market order matching engine is simply to match buy and sell orders that are submitted to electronic trading networks or markets.

It is the best to imagine the "Market Order Matching Engine" as a poll mechanism looking at actual best bid and ask price level for "customers" which want to do business with each other. If there are willing "customers" the matching engine matches those "customers" at the best bid or best ask in order to complete the business between both parties and finish the transaction.

If there are not or very few buyers or sellers at the currently "polled" price level, the matching engine will take the next price level, which in this case is one price level lower, in order to match buyers or sellers with the supply on both sides of the book.

Exhaustion

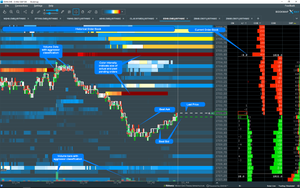

The basic understanding of the "Market Order Matching Engine" is, from my point of view, important because if you watch a visual order book like Bookmap™ or Jigsaw daytradr you will notice every trading day that at certain price levels there is no demand (see picture below). The price bounces a tick (or pip) down or up and reverses fast to the next price level.

The explanation is described above: The "Market Order Matching Engine" polls for buyers or sellers at best bid or ask. If there is are no or not enough buyer and seller to process all outstanding limit orders the engine jumps to the next lower price level to find traders who are willing to do business.

In other words an exhaustion price level is "A price of last seller" in case of a downtrend and "A price of last buyer" in case of an uptrend.

Why?

Imagine for a minute that the market is a hi-rise building. Price can rise up when the ceiling is broken and it can move down when the floor is broken. The market does have a ceiling above and a floor below. This is in the form of limit orders and this is what we refer to when we talk of "liquidity". In the market some floors/ceilings are thicker than others and some are thinner than others.

Something needs to "eat" these ceilings for price to move up. The eater of liquidity is called a "market order". When someone submits a market order to the market it eats some liquidity and makes that floor/ceiling a little bit thinner.

To trade a market you either need to provide liquidity (limit order) or consume liquidity (market order).

This is what causes price moves. You will often hear people say "price moves up when there are more buyers than sellers". This is impossible! The markets are a mechanism for matching buyers and sellers.

If there is no seller, you will not be buying anything. And, if there is no buyer, you will not be selling anything.

See also Liquidity 1-3.

Let's have a look into the screenshot above. As you can see buy market orders were consumed by sellers. This is also known as absorption. There is no interest to make business at 2775.00. Or in other words: There are no market participants to trade with each other in order lift the offer.

Another example in screenshots above shows

- absorption at 2740.50 with addtional "stacking" at this price

- fading interest in trading this level

Most order books have a Delta or Snapshot column. This information gives us more information on the pulling and stacking of limit orders. It shows the change in the quantity of limit orders at that level since inside bid/offer last moved up or down. In Bookmap it is labeled "Quotes Delta" and it shows the net changes to the limit orders, taking into account what has actually traded.

Exhaustion and Time

Time is besides the traded price the most important factor in trading.

I am considering this statemanet as a general rule in trading. It has nothing specific to do with exhaustion.

The pictures above shows that significant reversals need some time. It is not possible to derive a rule from it but you'll will see and experience every day trading situations where significant reversals takes some time to reverse.

We can also see pull backs with immediate reaction at the traded price level. They are based on the same principle. My intention is to show that there is enough time for the trader to make an objective decision based on the given chart and market. There is no need to take every little price action during a trading day.

In terms of supply and demand, markets turn at price levels where supply and demand are "most" out-of-balance. In other words, the more out-of-balance supply and demand is at a price level, the stronger and quicker the turn in price

This is because of the supply and demand imbalance. At that same price level, you have the potential for the most activity, but the reason you don’t get much trading activity is because all that potential is on one side of the market, the buy (demand) or sell (supply) side.

Trade Ideas

Exhaustion in Excess Phases

All excess phases are characterized by:

- One or more large volume clusters

- Large volume bar

- Volume divergences

- flat or divergence Cumulative Volume Delta (CVD)

- long term high liquidity above or below the exhaustion level

- no or very little trading volume in the "Chart Range Accumulated Volume Profile" (CVP)

As described in my previous post most of the buyers or sellers are excited about a price move and most of them are joining the move too late. The caricature below illustrates this behavior best. When there are no more buyers or sellers who support this acceleration the price dries out. The matching engine doesn't find enough traders to match between market and limit orders. There are still few traders trying to buy or sell but too little to lift or sell the limit order part of the book.

Trade Idea

- Waiting until large volume settles

- Watching for divergences in volume and cumulative delta

- Wait until price test the large volume area and long term high liquidity area again

- Seeing low volume on CVP

Some Examples

Here are some good examples of above described characteristics of the ES and the trading ideas behind.

Exhaustion and Reversals (Pull Back)

Exhaustion in reversals or pull backs are very common in an up or down trend. Technically speaking it is a retracement. You can use classical technical analysis tools like fibonacci or measured move numerics. The uncertainity in this kind of analysis is, now and then, it's inaccuracy. For example you can assume that a 38,2% percent or a 2 point retracement should take place. But you will never know. I think it is more objective to see what is really happening in the order book at these levels.

Charateristics of pull backs:

- stop runs - price reverse

- profit-taking or partial profit taking

- imbalance in the order book indicated by short term liquidity above or below

- global trend continuation (draw a line if neccessary)

- takes a short time to reverse

Trading Ideas

If you missed the move after a big volume area or a stop run wait for a pullback and take appropriate action, when

- short term liquidity indicates imbalance in the order book

- price goes towards the short term liquidity

- it takes a short time before price moves on

- seeing the action behind this move (zoom in)

- no volume traded at this level (Cumulated Volume Profile)

- divergences in Cumulated Volume Delta are clearly visible

Please Mind

Excesses and Exhaustion happens all time in ALL tradeable instruments (Futures, Shares, Forex, Commodities, etc). Basic principles described in this article are valid for all instruments, although you will notice that described excesses at the top or bottom are very different for Treasuries, Commodities, Shares etc.

Aggressors

As stated at so many posts within this blog, we never know when aggressors are about to enter the trading arena. A no traded price level is not at all a signal for exhaustion. It is a signal that at the taded time there was no trading demand.

I would be happy if you share your thoughts and ideas about how to recognize and trade exhaution opportunities.

Comments